By: James Reyes-Picknell

CFOs, you really need to know that maintenance can help you be strategic in achieving greater outputs, at low cost and for a minimal investment. Maintenance and Asset Management Managers, you need to help finance achieve its goals of long-term sustainability and enlist Finance as your ally in order to do that. Both groups are after the same results. Understanding this is a key to becoming partners in sustaining our businesses. For consultants, it is important to understand the synergistic relationship of these two groups so we can advise our clients on the opportunities they may be missing.

In a recent project the author identified approximately $100 million in annual savings, nearly $1 billion in potential annual revenue gains, and all for less than a $20 million investment in maintenance and reliability of physical assets. That was a multi-site mining operation struggling with its operating costs because of its lack of understanding of good maintenance practices. They were leaving a lot of money on the table and just didn’t see how much it was worth. That small investment could have the same business impact as a much larger investment in an entirely new mine!

Most businesses that are struggling with operating costs and unreliable production are likely in the same boat and missing an opportunity.

Let’s look at our respective roles in maintenance and finance. We physical asset folks restore and sustain functionality of our physical assets. Finance and accounting are not the same thing.

Let's talk about accounting first. Accountants help all of the business keep score by tracking what has happened with the business assets (money). It is inherently backward looking. They log the financial transactions we’ve already done and show us, via the balance sheet, income statement and statement of cash flows, what our “score” is.

They can analyze the past, as it is a reflection of our past behavior, and to project where we might be headed if that behavior continues. Even though they forecast the future based on the past, it’s a good forecast unless we change behavior. Accountants and financial managers who truly understand the business, help by suggesting future courses of action that might prove beneficial to the business. Of course those suggestions are often expressed in financial terms like reduce this cost, increase margin, etc. We technical folks don’t always understand what they mean or just how to achieve it. It is often our lack of financial literacy that holds us and our companies back.

Accountants are helping to preserve the financial integrity of the company and ensure its assets are valued properly so that shareholder value is maintained. However, while they understand the business, much the way any business school graduate would understand it, they do not always understand all that it takes to make it work. They are not experts in human resources, IT, operations, production methods, engineering nor maintenance.

Good financial managers will usually have a deeper understanding of these and how they impact where the business is headed. They go beyond the accountants and look more deeply into what is being done that drives the numbers that accounting tracks.

Sadly, even with good financial managers, maintenance is one area that can be sadly misunderstood. It may even be a mysterious unknown to some. To the accountant, it is little more than an expense on the income statement, yet it is truly so much more! If you are in finance, then you really need to understand it more deeply. It does have a potentially big impact on your business.

Maintenance produces sustainable uptime (asset availability). That uptime enables you to produce both goods and/or services, which in turn, generate revenue. When you are “down” (unavailable), you stop generating revenue and your costs per unit of output go up. When your production is "down", you are spending more on maintenance and earning nothing. When you are “up” you generate revenue. You also have the opportunity to spend the least amount on maintenance by focusing on proactive activities. That proactive maintenance costs 1/3 or less than the cost of reactive repairs. But we don’t always use our available uptime so wisely. If we don’t invest in doing the right proactive work, then we risk making our business as a whole, less sustainable.

By “sustainable” I mean that the uptime you've achieved will last. It isn’t just about the environmental aspects, although they too may become more sustainable as assets work properly.

Some physical assets, like a computer monitor, are intended to be used for a short time only but many others, particularly those in which we invest the most capital, are intended for use over a very long time. Some, like heavy plant equipment and your buildings will last decades at least. Maintenance is the function that, if done correctly, will sustain them in a functional state. As we produce, we consume that physical asset functionality very slowly (they degrade). We have an opportunity to monitor that degradation, then act proactively to reverse it (through restoration activities known as proactive maintenance) without production disruptions. Maintenance (the department) has the primary responsibility for doing this only if we allow it.

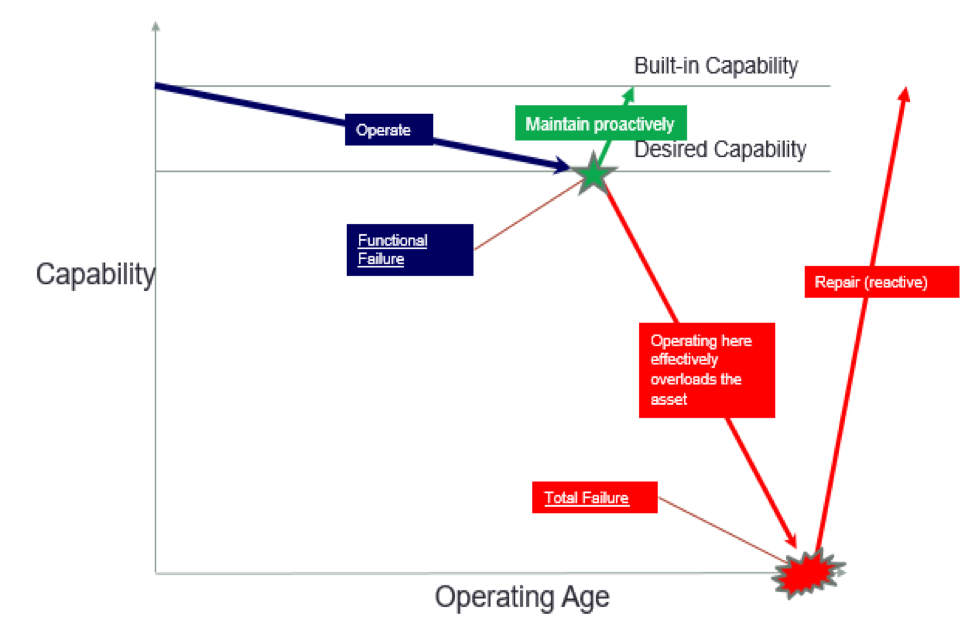

In the figure below we can see built in asset capability and, below it, the level of capability we need for the business. That must always be below what the asset is capable of delivering or the asset won’t last long. You can see the slow degradation of the asset as we use it, eventually rendering the asset capability less than we want. If we maintain before that point, we restore it at lower cost and at a time of our choosing. If we go beyond that point, degradation accelerates and the asset fails – always at an inconvenient time and while it is in use. Restoration from that “broken” state is always slower and more costly.

The right maintenance, done the right way and at the right time will sustain the asset in that band of capability between “built in” and “desired”. It will do it at the lowest practical cost and provide the least disruption to operations for the shortest periods of time. It is precisely that which many companies don’t do well!

Production produces, accounting keeps score, purchasing buys new stuff, marketing and sales generate product or service orders from customers, logistics moves the physical product to those customers, finance keeps the wheels greased with cash, executive management decides on the future. Everyone contributes to generating value, but it is only maintenance and finance have a role to play in sustaining the value of the company’s assets – finance looks after financial assets (including the functional value of its physical assets), while maintenance looks after physical assets in the physical sense. Maintenance needs sufficient investment in its capability and capacity to fulfill its role. It may show up as a business expense on the income statement, but it requires investment itself to sustain company asset value.

At times, the views of finance and maintenance are at odds, and that is both unnecessary and counter-productive. Maintenance may be treated as an expense but cutting the money available for it. For instance, elimination of maintenance training reduces needed skill levels. Cut backs in proactive maintenance will allow too much asset degradation. Both result in slow degradation of asset capability and long term pain. They do save money in the very short term, and then damage productive and revenue generating capacity in the long term - sometimes badly. Cutting costs is not always the right decision - you cannot "cut" your way to prosperity. Even if revenues are down due to loss of productive capacity, you need to invest in corrective maintenance to restore it. Companies almost never leave their assets in a failed state for long, regardless of the cost (usually high) to bring them back to service.

A well maintained plant will be more reliable and surprisingly less expensive to maintain in that state proactively. If you want lower maintenance costs (and who doesn’t), then you need to invest in reliability programs to ensure you are doing the right maintenance. You also need to invest in maintenance processes and skills to ensure that maintenance is done the right way and most efficiently. Once you achieve that, it requires a relatively low sustained investment to keep it that way and your costs overall will be far lower.

Consistent failure to invest in proactive maintenance is a very common and massive mistake in any business with physical assets. It is however easy to get in that state. Lack of proper management and understanding of the nature of asset behavior will naturally drive your operation in that directly. Being proactive requires more insight and more diligent management. It pays off because being Proactive is the least expensive form of maintenance and it produces the most Uptime (asset productive capacity).

Finance and accounting seldom forget their role. They understand how money makes a business work well and they have a duty to ensure it is used wisely. They seldom allow the “immaterial” to distract them. Give a CFO or a controller a convincing business case that shows what you want to do, shows that it can add substantial value, and you’ll usually get the green light.

I've often found that it is the financial people within my customers' businesses who seem to understand the value of maintenance improvements better than most. They have often proven to be very helpful in achieving it. However, many employee maintainers get too wrapped up in the technical details and forget that their role is really to make the business profitable.

Maintainers and asset managers are usually technical people who like to do things that are technical, often with our hands, and we like to get absorbed in the details. It is in our blood (so to speak). We know all too well that the "devil is in the detail". Sadly we get a bit too distracted by the details. Those details may be important to your technicians and engineers, but to the manager – they are immaterial. As managers, we are in a forest, yet looking at the leaves too closely.

As managers we need to remain cognizant of our business role – manage to the benefit of the business, not just focusing on the minutia of day-to-day maintenance and failures. Even if we get out of that mode we need to remember that doing what’s “best practice” may actually be too expensive for the business and harmful in the wrong circumstances. Ignoring “best practice” however, is just plain irresponsible. We need to assess what is "best for our business" and take appropriate technical action. To do that, we need to think about the business and not just our role in keeping assets running. Sometimes, we may need help to do that and finance is the first place to go!

In fairness to maintainers the world over, there are many accountants who get wrapped up in the details also. Accuracy is important but it is not always material (as they say it). They too must keep out of the leaves, but we are not here to tell them how to do their job. Good finance people will do that for them. We technical people are here to understand what they do and interact with them in ways that benefit our businesses. We as maintainers need to learn their language so that we can help them understand us and be more supportive.

Recognize that we have these similar roles of sustaining the assets of our companies, learn to speak the language of business, go beyond the purely technical and your job can be a lot easier.

About the Author

James Reyes-Picknell is the Principal Consultant and Co-Founder of Conscious Asset. He specializes in the management of asset, maintenance and reliability and leads the process improvement efforts and delivers much of the organization’s training. He is a Professional Engineer, Certified Management Consultant, and Certified Asset Management Assessor.

James has co-authored “Reliability Centered Maintenance – Re-engineered: Practical Optimization of the RCM Process with RCM-R®“, in 2017. And he is the best-selling author of “Uptime – Strategies for Excellence in Maintenance Management“, 2015, several other books and many published articles in a variety of magazines. James is a teacher, trainer, speaker and management consultant who focuses on finding hidden value in his client' operations.

To learn more, visit: https://consciousasset.com/